All imported fruits subject to SST, including bananas and rambutan, says MOF

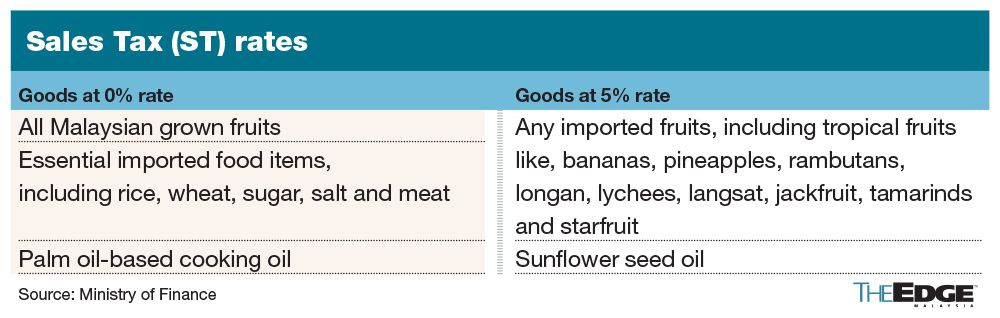

KUALA LUMPUR (June 11): All imported fruits will be levied with a 5% sales tax, including tropical varieties such as bananas, pineapples and rambutans, according to the Ministry of Finance.

Other imported fruits such as lady’s finger, cavendish and chestnut bananas, longan, lychees, langsat, jackfruit, tamarinds and starfruit will also be taxed.

But fruits grown locally in Malaysia are exempted from the expanded sales and services tax (SST) set to take effect in July 2025, the MOF said in a statement Wednesday.

Under the new tax regime, agricultural produce grown in Malaysia is not considered “manufactured” goods and is exempt from sales tax that applies to locally manufactured goods and imported goods, the ministry said.

“The Ministry of Finance wishes to confirm that fruits locally grown in Malaysia are exempted from sales tax,” the statement read.

The clarification was issued following concerns over the inclusion of tropical fruits in Sales Tax Gazette Order PU(A) 170/2025, which itemises goods subject to a 5% sales tax.

Essential imported food items, including rice, wheat, sugar, salt and meat, are exempted from SST. Palm oil-based cooking oil, Malaysia’s most commonly used vegetable oil, is also exempt, while sunflower seed oil will be subject to a 5% sales tax.

The ministry also provided policy clarification for companies providing newly taxable services, such as rental, stating that they would need to first establish whether the revenue threshold of RM500,000 for rental has been reached within 12 months.

“If they have reached the revenue threshold in July, then the company will need to register by the month of August and only begin to charge service tax on their services beginning September 1, 2025, which is more than two months from now,” the ministry said.

The ministry also reiterated that the government will not impose penalties on companies working to meet registration and reporting requirements by Dec 31, 2025.

“Appreciating the need to provide time for affected companies to understand how the SST revisions may apply to them,” the MOF said, “the government will provide a grace period and not impose penalties on companies that genuinely have made the effort to comply.”

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Comments