Khazanah among world’s best-performing sovereign wealth funds in 2024

This article first appeared in The Edge Malaysia Weekly on February 10, 2025 - February 16, 2025

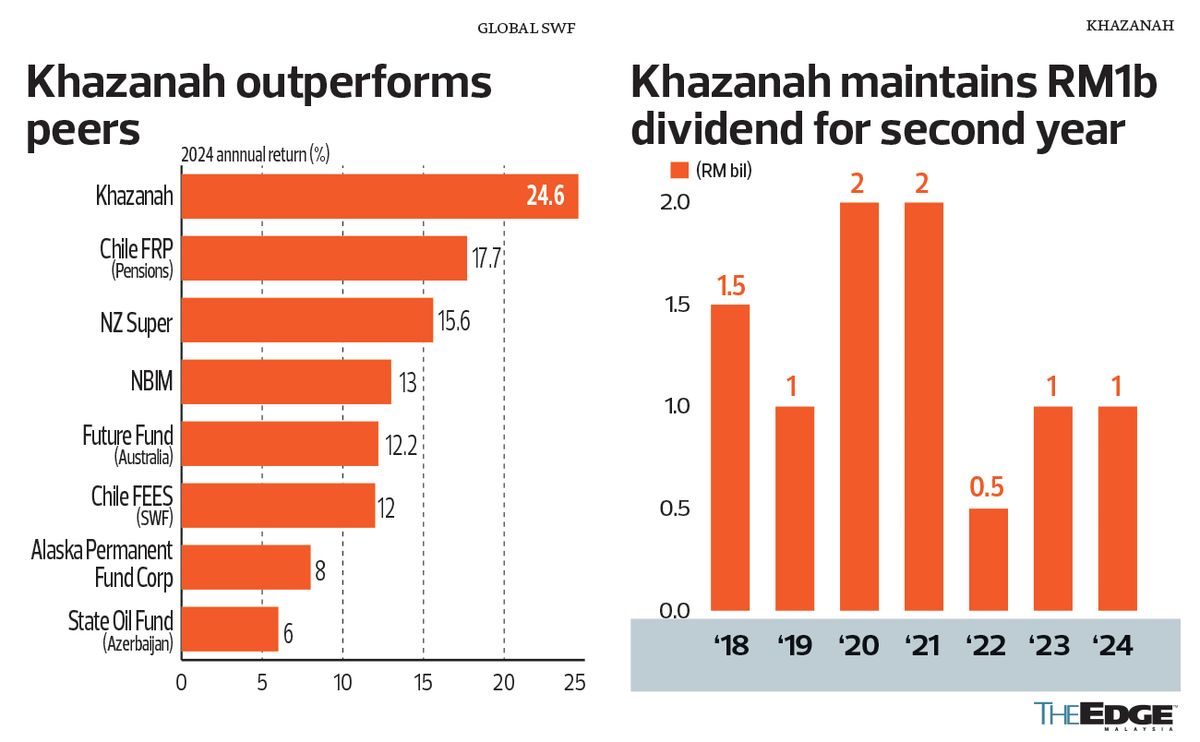

KHAZANAH Nasional Bhd was recognised by Global SWF as one of the world’s top-performing sovereign wealth funds last year, recording a 24.6% jump in annual returns.

Khazanah’s 2024 returns surpassed the 13% gains achieved by Norway’s Norges Bank Investment Management, the world’s largest sovereign wealth fund, which has more than US$1.7 trillion (RM7.5 trillion) in assets under management.

It is also far ahead of other peers in Global SWF’s notable mentions, including Chile’s Pension Reserve Fund (FRP), which posted 17.7% gains for the year, and second runner-up, New Zealand’s NZ Super Fund (15.62%).

Khazanah, whose investee companies include CIMB Group Holdings Bhd (KL:CIMB) and Tenaga Nasional Bhd (KL:TENAGA), benefited from strong public equities in both Malaysia and developed markets in the year. Nearly 60% of its investment portfolio is in Malaysia.

This is in line with key trends identified by Global SWF, a data platform that tracks more than 400 state-owned institutional funds. It noted that “public equities ruled”, as heavy exposure to stocks delivered “the biggest wins” while the real estate and renewable energy segments struggled.

In 2024, Malaysia’s public equity market capitalisation topped RM2 trillion for the first time. The benchmark FBM KLCI rose more than 12% — its first annual gain in three years. The FBM EMAS Index, which comprises the top 98% of Bursa Malaysia’s Main Market constituents by market cap, rose 15.83% in the same period.

The ringgit gained 2.7% against the US dollar and strengthened against many currencies, and Malaysia’s GDP growth is pencilled in at between 4.8% and 5.3% for the year.

The Malaysian equity market’s outperformance also lifted returns for fund management firm Permodalan Nasional Bhd (PNB), which similarly has almost 60% of assets in domestic public equities. In 2024, it posted its highest distributions in six years for its benchmark Amanah Saham Bumiputera fund (5.75% including bonus).

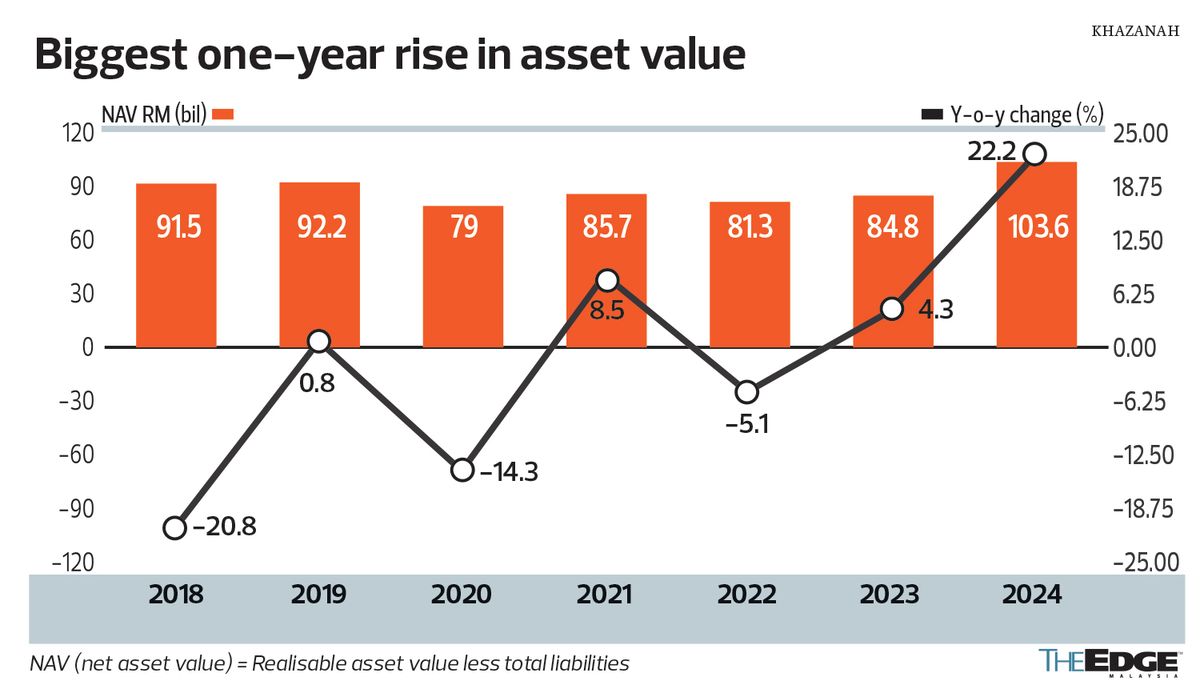

The 24.6% time-weighted rate of return (TWRR) on Khazanah’s net asset value (NAV) in 2024 compares with the 5.7% recorded in 2023. It was the fund’s best annual performance since it commenced operations in 1994.

Khazanah managing director Datuk Amirul Feisal Wan Zahir says in a statement that its portfolio growth was “driven by the strong performance of our Malaysian investments, particularly our holdings in the major constituents outperforming the FBM KLCI, on the back of strong domestic market performance, continued growth of public equities in developed markets and the recovery in emerging markets.

“The significant influx of investments from both foreign and domestic sources reflects the confidence in our nation’s potential for sustained growth.”

The gains contributed to Khazanah’s RM5.1 billion in operating profit for 2024. In 2023, the sovereign wealth fund posted an operating profit of RM5.9 billion, which included RM1.8 billion in one-off gains from a restructuring linked to highway operator PLUS Malaysia Bhd.

Realisable asset value, which comprises the market value of all equities, securities and cash held, rose 12% year on year to RM151.3 billion last year, from RM135 billion. After deducting liabilities, NAV was RM103.6 billion, up 22% y-o-y from RM84.8 billion.

The RM18 billion increase in Khazanah’s NAV for the year also represented its best showing in years in that metric.

The share prices of Khazanah’s portfolio companies in Malaysia generally outperformed last year, on the return of foreign investors and a re-rating of the domestic market on optimism towards key investment themes such as the country’s data centre play.

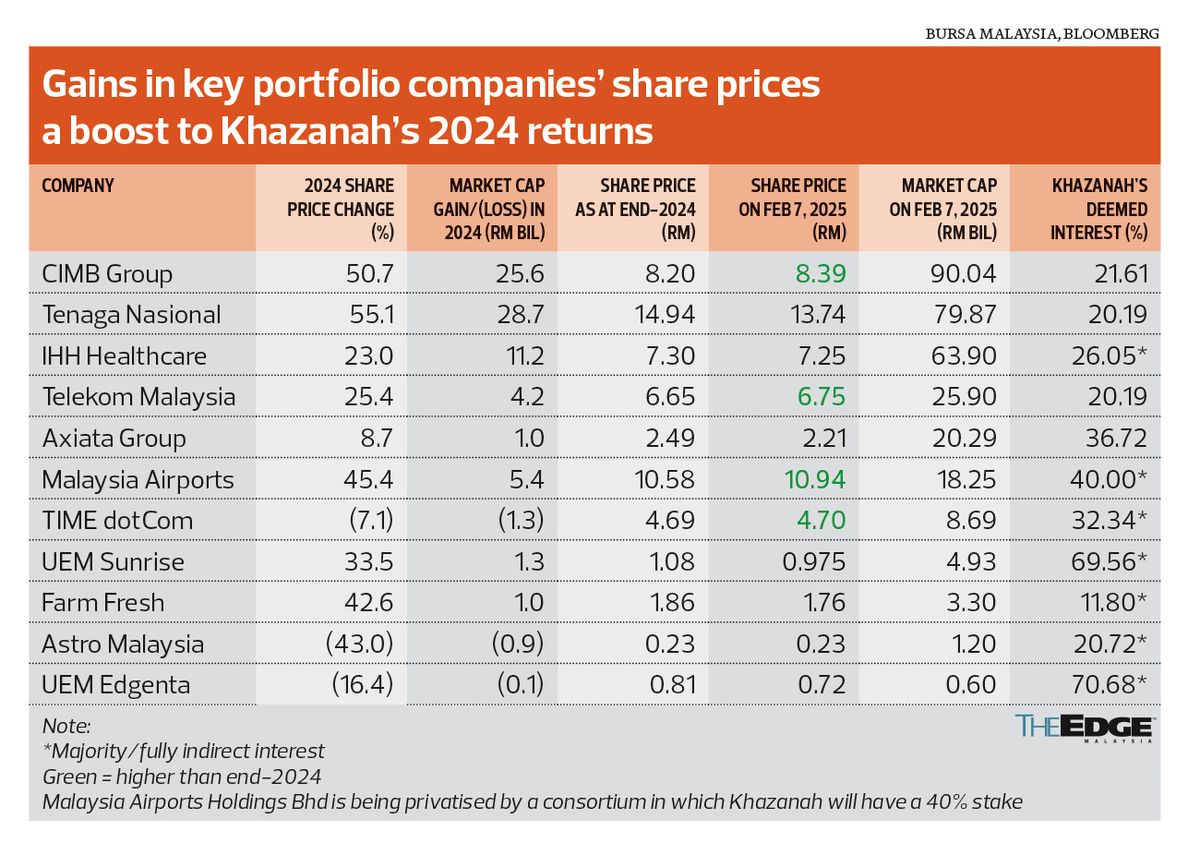

Gainers were led by Tenaga, whose share price rose 55.1% for the year, followed by CIMB (50.7%) and IHH Healthcare Bhd (KL:IHH) (23%). The gains in the three groups alone added RM14 billion in market value to Khazanah based on its shareholdings, back-of-the-envelope calculations show.

Other equities in Khazanah’s portfolio that outperformed in 2024 included Farm Fresh Bhd (KL:FFB), which surged 42.6%, Telekom Malaysia Bhd (KL:TM) (25.4%) and UEM Sunrise Bhd (KL:UEMS) (33.5%), although the absolute market cap adjustment on Khazanah’s portfolio was smaller.

Shares in Malaysia Airports Holdings Bhd (KL:AIRPORT), which is being taken private by a consortium led by Khazanah and the Employees Provident Fund (EPF), rose 45.4% last year. The privatisation will see Khazanah holding a 40% stake and EPF holding a 30% equity interest in the consortium; the remaining 30% will be held by Abu Dhabi Investment Authority (ADIA) and Global Infrastructure Partners (GIP), which is part of BlackRock Inc.

In 2024, 57.5% of Khazanah’s investments were located in Malaysia, down from 59.1% in 2023, excluding Dana Impak. According to Khazanah, the fund “will constantly rebalance” its portfolio, and the plan is to keep the Malaysian portion “slightly more than 60%” of its total portfolio.

The entire Khazanah portfolio is split between investment portfolios (93%); the remaining 7% covers developmental assets (meant to deliver high economic impact through long-term developmental investments), Dana Impak (focusing on socioeconomic impact) and Special Situations funds (focusing on assets that require turnarounds).

In a media briefing to announce Khazanah’s 2024 financial performance last Wednesday, Amirul Feisal says 2025 is not going to be an easy year, as higher-for-longer interest rates, coupled with a volatile environment on trade policies, will keep the US dollar stronger.

Thus, Khazanah sees the need to ensure its portfolio is resilient against global mega trends, which include deglobalisation, commodity price volatility, artificial intelligence adoption, a rising focus on tech security, and long-term shifts in global weather patterns.

The fund’s strategy is to drive value creation from Malaysia in energy transition, digitalisation and connectivity, as well as maintain its diversification strategy. The focus remains on “longer-term productivity and innovation”, Amirul Feisal adds.

“Having said that, Malaysia’s situation is favourable. China makes up 14% of Malaysia’s exports, but the US makes up 12% of our exports. We are pretty balanced as a nation ... In the fight between the eagle and the dragon, we are a kancil (mousedeer); we’ll play it smart [as a nation].”

On questions about its stake in content aggregator Astro Malaysia Holdings Bhd (KL:ASTRO), following the passing of Astro’s ultimate controlling shareholder Ananda Krishnan, Amirul Feisal says it will be treated like any other investment, noting that it will divest its indirect 20.72% stake in the group “at the right price”, considering content has become more commoditised because of competition from both legal and illegal streaming services.

He sees Malaysia Aviation Group Bhd (MAG), in which Khazanah holds a 83.58% stake, strengthening its long-haul connectivity to boost Malaysia’s global connectivity.

Through its energy arm UEM Lestra Bhd, Khazanah’s wholly owned UEM Group Bhd last year acquired a 51% stake in power producer NUR Power Sdn Bhd, which has a generation capacity of 310mw.

It also has an additional 130mw of gas-powered electricity generation capacity that will come online this year, and another 100mw solar farm that will be operational in two phases in 2025 and 2027.

UEM Lestra is also developing a 500mw solar farm in Baram, Sarawak, and a 400mw power plant to supply electricity to Bridge Data Centres — a company that designs, builds, and operates data centres in Asia-Pacific — through the national grid’s third-party access mechanism.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

| AIRPORT | 10.900 |

| ASTRO | 0.205 |

| BURSA | 7.940 |

| CIMB | 8.360 |

| FBMEMAS | 11991.670 |

| FBMKLCI | 1591.030 |

| FFB | 1.730 |

| IHH | 7.260 |

| TENAGA | 13.980 |

| TM | 6.900 |

| UEMS | 0.965 |

Comments