Private healthcare groups under selling pressure after PM's remark on expedited plan for standardised prices

KUALA LUMPUR (Dec 11): Shares of hospital operators fell on Wednesday, after the government announced that it would speed up the implementation of standardised prices for private healthcare early next year.

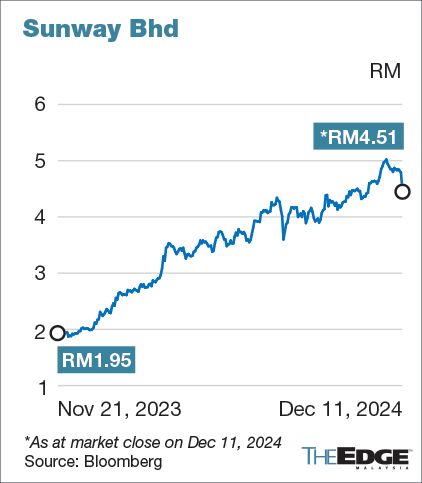

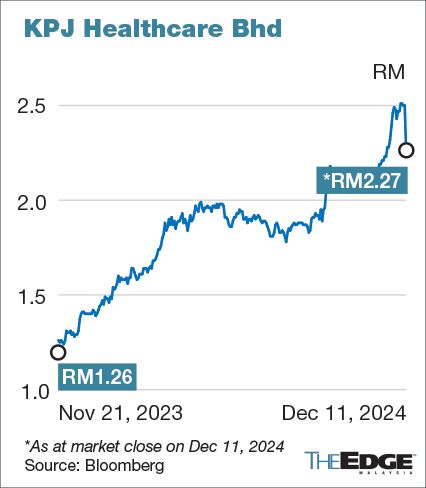

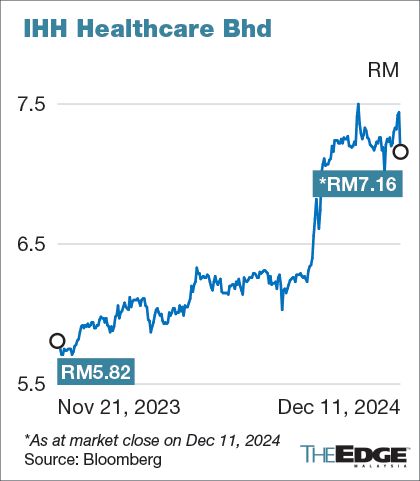

IHH Healthcare Bhd (KL:IHH) lost about 3.8% on Wednesday's close to settle at RM7.16, while KPJ Healthcare Bhd (KL:KPJ) was down 9% after losing 23 sen to close at RM2.27. Sunway Bhd (KL:SUNWAY), which also operates hospitals in Malaysia, dropped 28 sen or 5.85% to RM4.51 amid broader market weakness.

Bursa Malaysia Healthcare Index, which tracks 18 stocks including pharmaceutical companies and medical products makers, was the biggest loser after declining 1.69%.

The implementation, through a so-called diagnosis-related group (DRG) system, still requires extensive study and engagement with various stakeholders, Oong Chun Sung, an analyst with RHB Investment Bank told The Edge.

“Also, the regulations are not capping the price entirely, but come with the intention to get the hospitals to optimise their resources by not simply charging the patients with unnecessary procedures, medicines, screenings, and such,” he noted.

On Tuesday (Dec 10), Prime Minister Datuk Seri Anwar Ibrahim said the government is looking to expedite the rollout of DRG, amid skyrocketing private healthcare costs, and an impending spike in premiums for medical insurance that have prompted public outcry.

Insurers pointed to the soaring medical inflation for their increase in premiums, while private healthcare operators have blamed rising costs in raising prices of their treatments, in a bid to protect their profit margins.

The insurance industry has been pushing for private hospitals to move from fee-for-service payment models, to DRG or value-based healthcare, since 2023, according to Oong.

“Once the transition to DRG is successfully navigated, we expect that both hospitals and patients will stand to gain from a more efficient, cost-effective, and outcome-focused healthcare system,” he said, recommending that investors consider buying into the current selldown.

DRG is a healthcare payment system which specifys a fixed amount based on the complexity of the case, rather than the conventional fees-for-services.

Hospitals would receive a set amount for a particular surgery — which is negotiated between the payer and the hospital beforehand — and the hospitals will have to manage their resources within that budget. Countries currently practicing DRG include the US, Thailand, Australia and Germany.

The DRG proposal may be more of a signal to private hospitals to keep a lid on overcharging, and demonstrate to the public that the government is acting, said a fund manager who declined to be identified.

In the nearer term, hospital stocks are likely to remain under pressure, similar to the selldown in 2019, when the government proposed price control on drugs, he noted.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

Comments